Council Tax bands explained: check yours, costs and appeals

What bands mean, how to check in 60 seconds, 2025/26 costs by area, appeals, and discounts that could cut your bill.

Council Tax • 9 min read

Introduction

You move into a new place, the first bill lands, and your neighbour says they pay less. What gives? In most cases, the answer is your Council Tax band. This guide makes it simple: what bands are, how to check yours in under a minute, what typical 2025/26 charges look like, and how appeals work across England, Scotland and Wales.

Quick note: Northern Ireland uses a different system called domestic rates, so this guide focuses on Great Britain.

What are Council Tax bands? A quick definition

Council Tax bands are value‑based categories assigned to domestic properties. Your band is used by your local council to set your annual bill. There are eight bands (A–H) in England and Scotland and nine (A–I) in Wales.

- England and Scotland bands are based on what the property would have sold for on 1 April 1991.

- Wales uses values as at 1 April 2003.

Each council sets its charges per band, so costs vary by postcode. Bands do not automatically change when the market moves. Valuation dates and approach are set out in VOA guidance (England & Wales) and by Scottish Assessors (SAA) in Scotland.

How bands are set in England, Wales and Scotland

Assessors look at factors like a property’s size, layout, character, location and valuation‑date sale evidence. The VOA notes it does not use price indices for valuations.

- England (1991 values): A up to £40,000; B £40,001–£52,000; C £52,001–£68,000; D £68,001–£88,000; E £88,001–£120,000; F £120,001–£160,000; G £160,001–£320,000; H over £320,000.

- Wales (2003 values): A up to £44,000; B £44,001–£65,000; C £65,001–£91,000; D £91,001–£123,000; E £123,001–£162,000; F £162,001–£223,000; G £223,001–£324,000; H £324,001–£424,000; I over £424,000.

- Scotland (1991 values): A up to £27,000; B £27,001–£35,000; C £35,001–£45,000; D £45,001–£58,000; E £58,001–£80,000; F £80,001–£106,000; G £106,001–£212,000; H over £212,000.

Adding space usually won’t change your band until the property is sold, except in specific cases such as creating a self‑contained annexe. Source: VOA guidance.

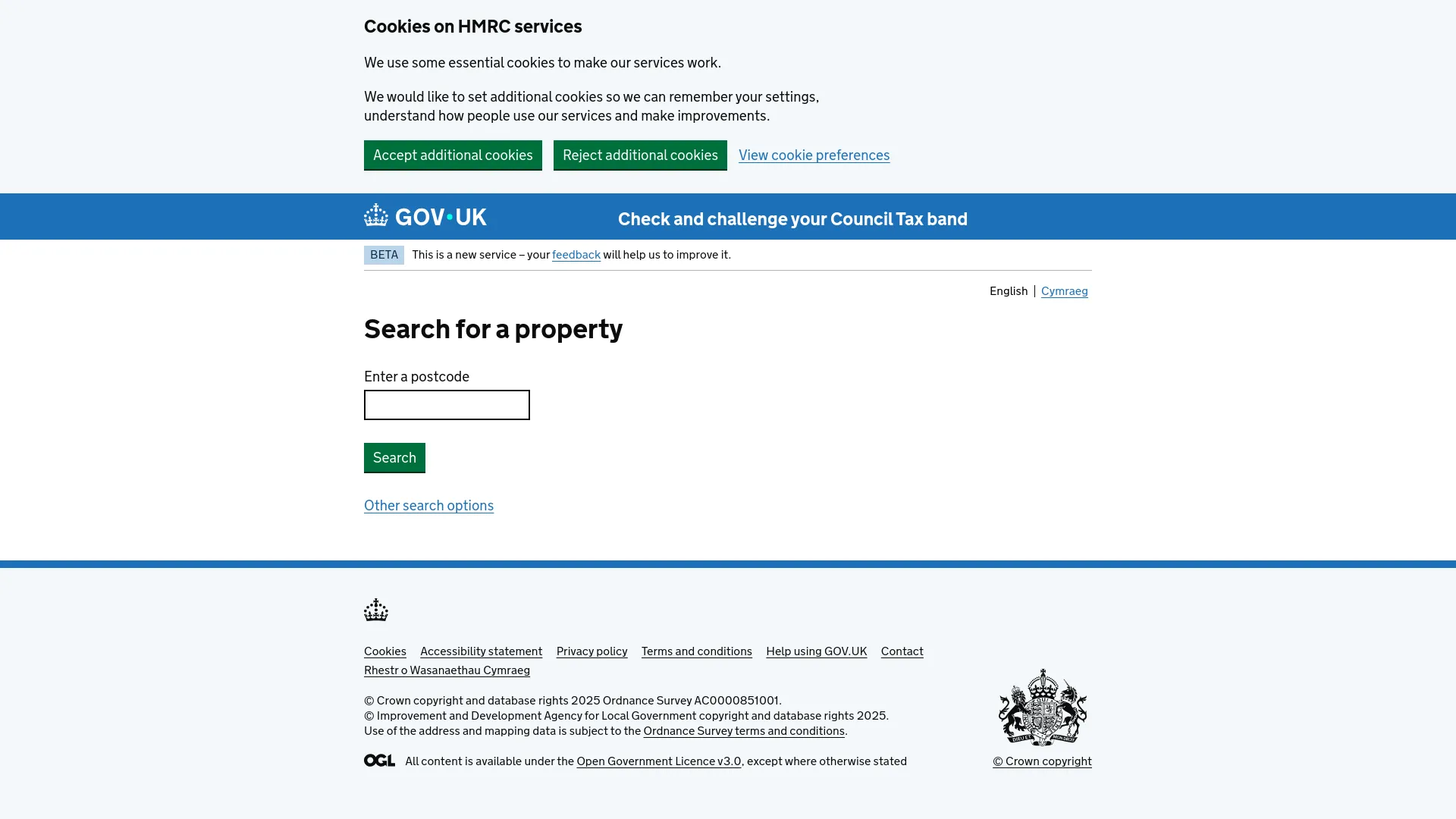

Check your Council Tax band in 60 seconds

- England & Wales: use the official lookup: Check your Council Tax band on GOV.UK.

- Scotland: search on the Scottish Assessors (SAA) portal.

- Compare your band with similar neighbouring homes to spot red flags.

- Save screenshots or notes—handy if you later challenge.

On GOV.UK, you can go straight from the lookup to the “challenge your band” journey if needed.

How much does your band cost in 2025/26? Why your postcode matters

Each council sets annual charges per band, so Band D in one area can cost more or less than Band D somewhere else. Examples for 2025/26:

- Brent (London): Band D £2,133.15. Source: Brent Council bands and rates 2025/26.

- Edinburgh: Band D total £2,163.90 including Scottish Water charges collected via the bill. Source: The City of Edinburgh Council 2025/26.

Check your own council’s website for the exact figures where you live. Scottish bills include separate water and sewerage line items set by Scottish Water.

Estimated monthly payment: £190.00

Annual total after discount: £2,280.00

Ask your council if you can spread payments over 12 months.

DIY sense‑check: estimate your 1991/2003 value and spot misbanding

- Compare your band with similar nearby homes (same street, size and age).

- Estimate what your home might have sold for at the valuation date (1991 in England/Scotland, 2003 in Wales) using older sales data or reputable archives. This is only a rough sense‑check—VOA does not use price indices for formal valuations.

- Line up your estimate against the thresholds above. Remember: sometimes the check shows neighbours are under‑banded rather than you being over‑banded. See BBC explainer coverage for common concerns.

Sources: VOA guidance; BBC News Council Tax explainer.

Discounts, reductions and exemptions that can cut your bill

- Single‑person discount (25%). People who are “disregarded” for Council Tax (for example, certain students or apprentices) don’t count towards the total.

- Disabled Band Reduction. If your home has features essential for a disabled resident (e.g., an extra bathroom or space), you may drop to the next lower band; if already in Band A, councils apply a typical ~17% reduction.

- All‑student households. Usually exempt—your council will ask for proof of student status.

- Council Tax Reduction (CTR). Means‑tested help via your local council; can be up to 100% in some cases and can be combined with discounts above.

Apply and read the rules: England & Wales discounts, Disabled Band Reduction, Scotland discounts and reductions.

When and how to challenge your Council Tax band

England & Wales (VOA)

- Formal proposal: within 6 months of becoming the taxpayer, or within 6 months of a band change. The VOA must review.

- Evidence‑led review: outside those windows, provide strong evidence (comparable lower‑band homes; material facts like size/layout; valuation‑date price indicators).

Scotland (SAA)

Use the Scottish Assessors’ appeal routes and timescales on the SAA portal.

Outcomes can be a decrease, an increase or no change. Keep paying your current bill while your case is reviewed.

Common triggers for reassessment include creating/removing a self‑contained annexe, major demolition, conversion to domestic use, or new builds. See the VOA overview for details.

Checklist: address and current band; comparable properties and bands; floor area and layout notes; photos/plans if available; any valuation‑date evidence; screenshots from lookup tools.

Start here: GOV.UK: Challenge your Council Tax band.

Struggling with payments? Do this first

- Contact your council early to ask for a payment plan and request 12 instalments (you have a right to ask).

- Check eligibility for Council Tax Reduction and other discounts.

- Keep paying what you can to avoid reminder notices and enforcement.

Read the rules on reminders and arrears: GOV.UK Council Tax arrears.

About 118 118 Money: tools to keep your bills on track

The first step is always to check your band, discounts and Council Tax Reduction with your council. If you’re building your Financial Fitness, 118 118 Money supports progress with transparent, fixed‑rate personal loans and a simple‑interest credit card designed for clarity and control—plus app‑based account management. We assess affordability carefully. Borrowing to cover recurring bills isn’t right for everyone.

Plan ahead for annual bills by setting aside a monthly amount and using payment reminders in our app. Explore more tips in the Financial Fitness Hub.